Valuation Mission Statement

To provide an efficient and professional valuation service to all government departments and to monitor and review all property transactions within the Turks and Caicos Islands to ensure the correct stamp duty revenue is collected.

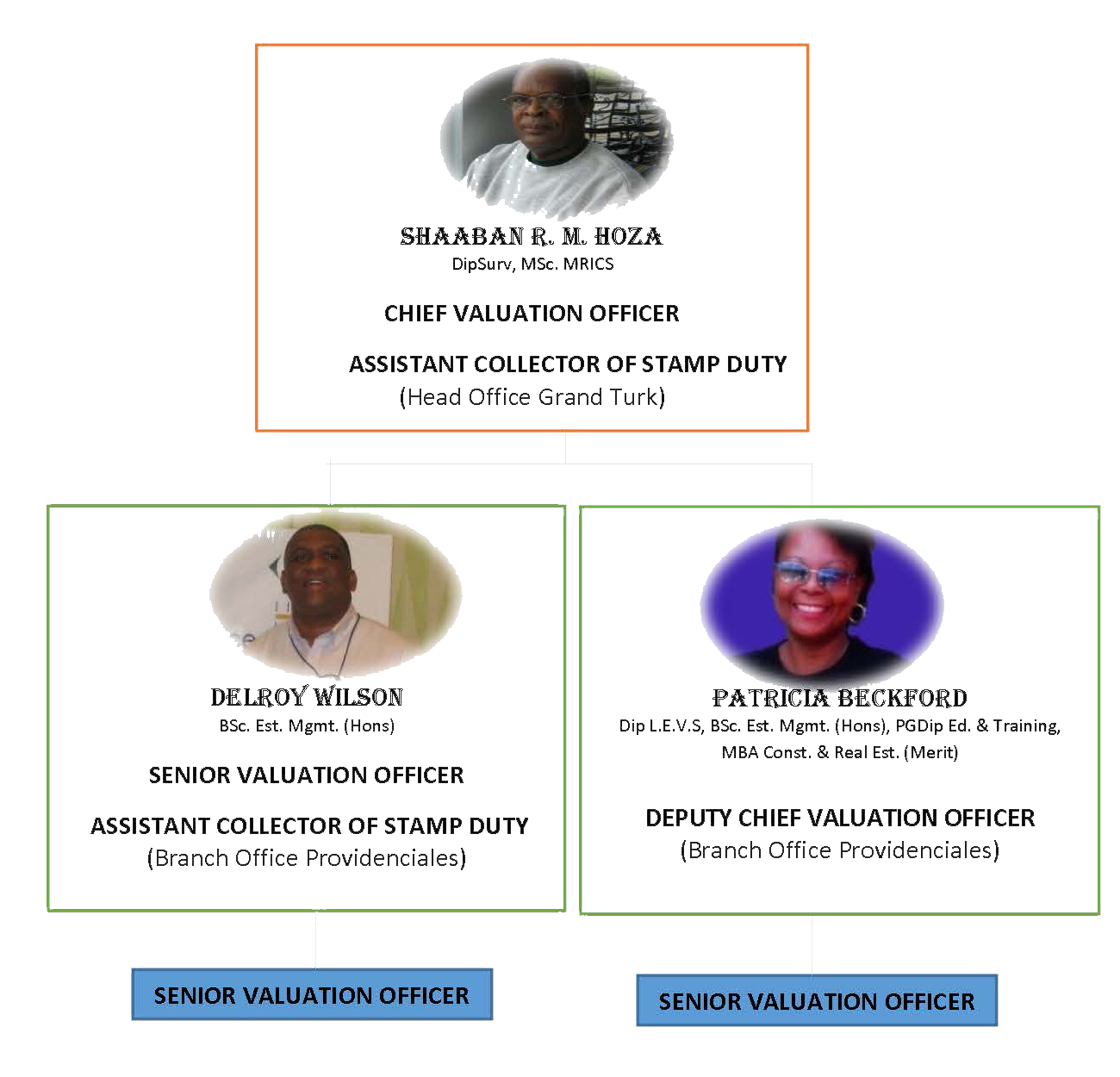

Department Structure

Department Head

The Chief Valuation Officer is the Head of the Valuation Department and, as such, has the responsibility to ensure that valuation work conforms to acceptable professional and ethical standards. In a nutshell he/she is accountable for what happens within the department. It is, therefore, directed that all official valuation work should be reviewed and approved by the Chief Valuation Officer or, in his/her absence, the person acting in that capacity before distribution to the user/requesting departments.

Sources of Valuation Work

The main originators of valuation work are:

- Crown Land Unit;

- Ministry of Government Support Services (Infrastructure, Housing & Planning);

- Ministry of Finance;

- Land Registry (Stamp Duty Ordinance);

- The Companies Registry {Land Holding Companies (Transfer Duty) Ordinance};

- Other government departments;

- Statutory Bodies.

Frequently Asked Questions

There are three commonly methods used to assessed properties which are as follows:

- Market Approach/Sales Comparison Approach: This approach adopts the principle that the value of one property may be derived by comparing it with prices achieved from market transactions of similar properties. It is widely used in straightforward residential, rural and commercial real property.

- Income approach: This approach is used to value properties that are let to produce an income for an investor. There are two main methods that falls under this approach and these are the investment and profits methods. The investment method utilizes the net rental income received from the property and a capitalization factor which is usually the yield. The profits methods on the other hand is used for properties whose values are derived from the trading potential of the business for which the building is expressly designed such as hotels or cinemas. Comparable is used to derive values for the key inputs in the discounted cash flow (DCF) valuation that includes net rent, yield, growth rate, discount rate, costs and disposal price.

- Cost Approach: There are two methods under this approach. There is the replacement cost/contractors method and the residual method. The replacement method is used to value properties that rarely exchange hand on the open market for example public buildings, stadium etc. It is hard to get direct comparable evidences for these properties. Such valuation is based on depreciated cost of the building element and the value of the land. The residual on the other hand is used to assess the value of a development site. It combines elements of the income and cost approaches. It requires calculation of the value of the completed development that will be reached by comparison with market transactions. The assessment of the development costs requires comparison to be made with build costs, fees, finance costs and other elements in similar project.

Head Office

South Wing Pond Street

Grand Turk, Turks & Caicos Islands

Branch Office

Butterfield Gold Building

Upstairs MoneyGram

Providenciales, Turks & Caicos Islands

Chief Valuation Officer

Shaaban R. M. Hoza

Tel No: (649) 338-2381

Email: SRHoza@gov.tc

Deputy Chief Valuation

Patricia Beckford

Tel No: (649) 338-5214

Email: PBeckford@gov.tc

Senior Valuation Officer

Vincent D. Wilson

Tel No. (649) 338-5241

Email: DVWilson@gov.tc