Step by Step Import Guide

Step 1: Gather Basic Import Documentation

The Customs Department of the Turks and Caicos is the main authority that regulates imports and exports within the country. Their main purpose is to collect the relevant revenues, grow the economy through trade facilitation, encourage vulnerary trade compliance and combat illicit trade activities. Before any individual/company can import goods into the Turks and Caicos, there are a number of documents that must be submitted to the Customs Department. There are six (6) main documents which are necessary to be completed depending on the nature of the goods being imported into the Turks and Caicos. These documents include the following:

- Cargo Manifest, which includes the Bill of Lading/Airway Bill

- Single Administrative Document (SAD) Declaration

- Commercial Invoice

- License/Permit/Certificates (applicable based on the activity)

- ASYCUDA World Application (applicable for brokers & companies)

- Concession Letter (For persons who qualify for exemptions on goods under Sections 70 and 71 of the Customs Tariff).

These documents can be downloaded from the Customs Department’ website. Click here to directly access them: https://customs.gov.tc/pgs?pg=forms.

Step 2: Classify Your Imports

Based on the classification of the product being imported into the Turks and Caicos, there are differing processes that would apply to the good. These groupings are as follows:

- Direct Imports: This refers to the general importation of products. This category covers a wide variety of products that can be imported into the Turks and Caicos with the exception of the other two categories and categories that are restricted or prohibited.

- Perishable Imports: This refers to any product or good that has an expiration date or has the ability to decay over time.

- Motor Vehicles Imports: This refers to the importation of any class of road-based vehicle with an internal combustible motor or any other type of motor.

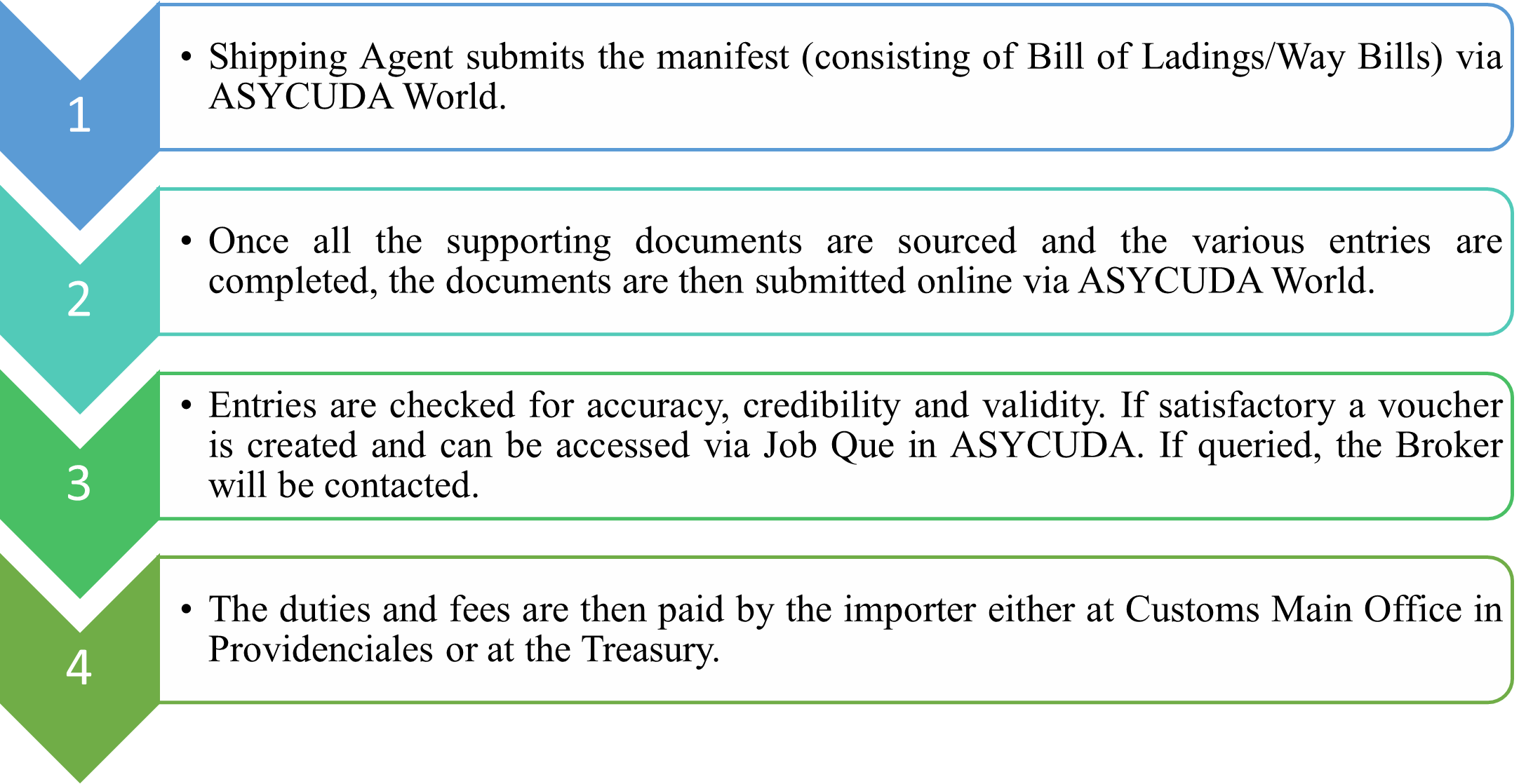

If you are interested in the general importation of goods into the Turks and Caicos, the following step-by-step guide will assist you in this process:

The ASYCUDA Platform can be accessed by clicking the following hyperlink that is located on the Customs Department’s website - https://customs.gov.tc/asy. The Customs Department reserves the right to conduct post audits after the arrival and clearance date of the imported product. For further information regarding detailed information or queries on their current available contact options available at the lower end of their website https://customs.gov.tc/.

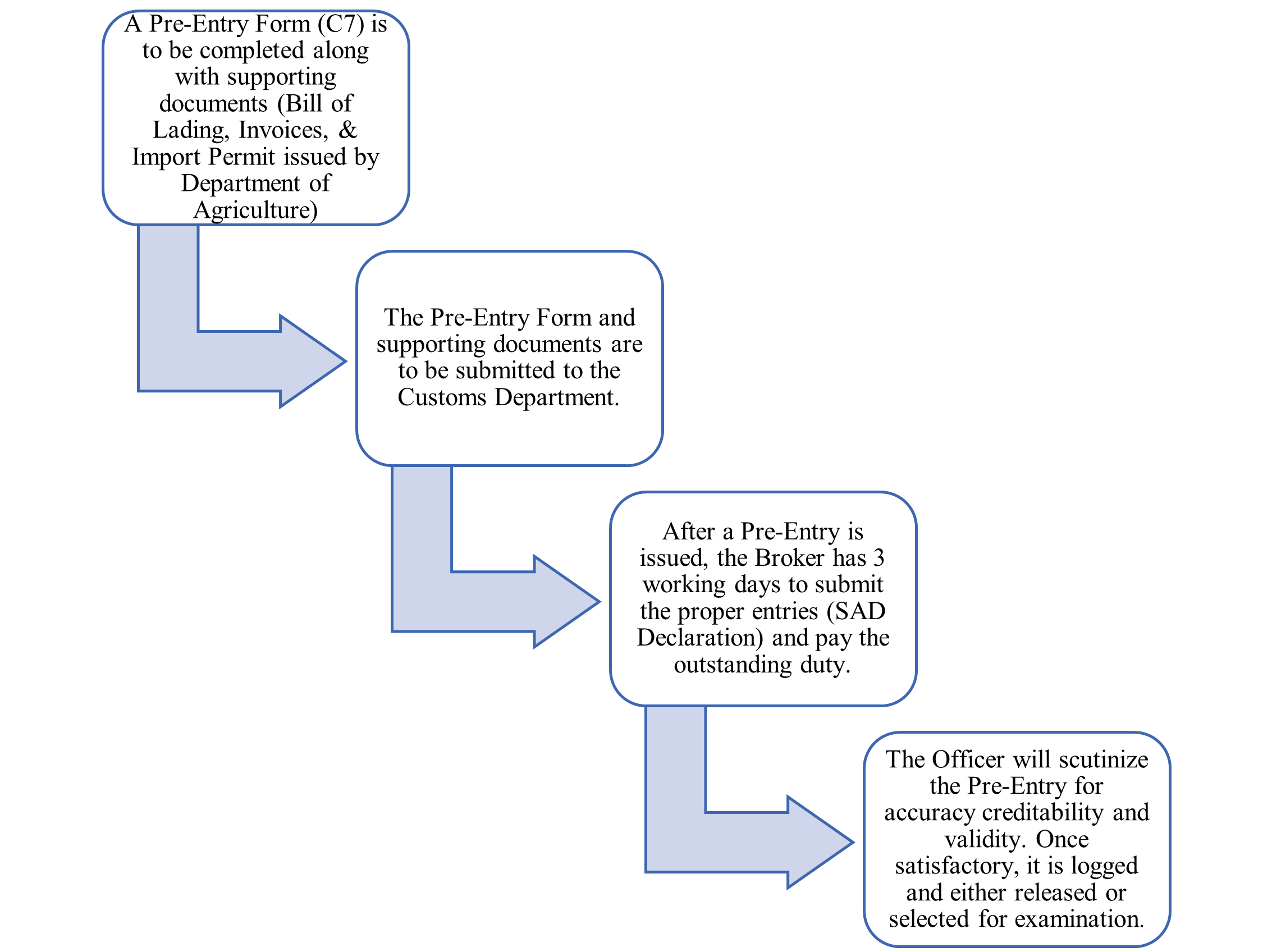

If you are interested in the importation of perishable products into the Turks and Caicos, the following step-by-step guide will assist you in this process:

STEP-BY-STEP GUIDE FOR PERISHABLE IMPORTS

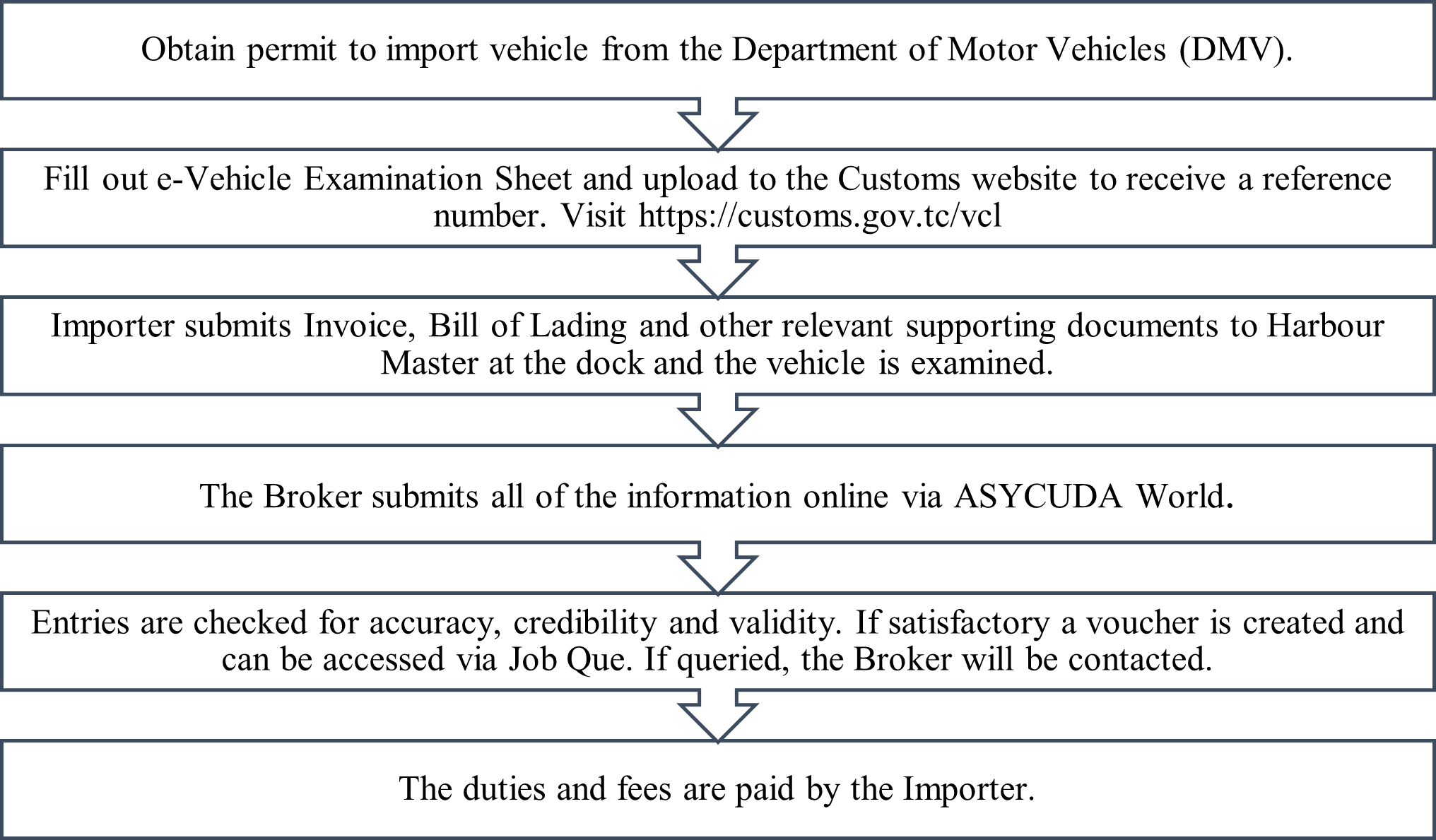

If you are interested in importing a motor vehicle into the Turks and Caicos, the following step-by-step guide will assist you in this process:

STEP-BY-STEP GUIDE FOR MOTOR VEHICLE IMPORTS

Step 3: Find out about Agricultural Import Requirements (if applicable)

The Department of Agriculture is responsible for the management, security and oversight of all agriculturally based and supporting structures in the Turks and Caicos. The following imported products/animals fall under the Department of Agriculture’s purview:

- Meat & Meat related Products

- Milk & Milk related Products

- Regulated Articles such as Fruits and Vegetables, Live Plants and Planting Materials, Cut Flowers, Mulch, Compost, & Bagged Soil

- Live Animals such as Dogs and Cats, Poultry, Livestock, Horses, & Other species

If you are interested to import any of the categories of products/animals listed above, the following documentation must be submitted to the Department of Agriculture:

- Application Form: This can be accessed via e-mail (agriculture@gov.tc) or by visiting the Department of Agriculture’s Offices in Providenciales or Grand Turk.

- Import Permit: Fruits and vegetables that weigh more than 25lbs require an import permit. All other categories of regulated articles require an import permit regardless of weight. In like manner, all animal and animal by-products require an import permit. In order to apply for an import permit, kindly e-mail the Department of Agriculture via agriculture@gov.tc.

- Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) Application Form: Only the importation of specific plants and animals requires a CITES Form. The list of plants and animals that require a CITES Permit along with CITES Application Form are available from the offices of the Department of Environment & Marine Affairs as well as the Department of Environment and Coastal Resources.

- Supporting Documentation: These can vary based on the type of product to be imported and the country of origin. A Risk Analysis may have to be conducted by the Department of Agriculture based on the country of origin or the type of product that is proposed by the trader to be imported. To request a comprehensive list of products that require risk analysis, kindly e-mail the Department of Agriculture via agriculture@gov.tc.

- Phytosanitary Certificate: This certificate is necessary to validate that a plant or product has been inspected in the country of origin and is free of pests, diseases and invasive species that may be a potential threat/risk to a country.

- Sanitary Health Certificates: These certificates are generally issued by the competent authority of the exporting country indicating the sanitary status of the animal or animal by-product.

AGRICULTURAL IMPORT PROCESS

Once all of the necessary documents from the checklist above have been secured, you can officially start the process to import agriculture-based products into the Turks and Caicos through the Department of Agriculture. In order to complete process, it is important to complete the following steps:

- A completed application form can be emailed to agriculture@gov.tc or submitted in- person at the Department of Agriculture Offices in Providenciales or Grand Turk. All supporting documents must accompany the application.

- All import applications will be processed within two (2) working days.

- A Risk Analysis may apply for certain commodities and country of origin and will require a longer processing period.

- Once all of the correct documentation is submitted, the application is reviewed, approved and an import permit is processed within two (2) working days.

- On arrival of the produce/animals by air or by sea into the TCI, once cleared by the Department of Customs , the produce/animals are then inspected and cleared by the Department of Agriculture. Items such as the live plants and cut flowers are inspected at offloading sites by the Department of Agriculture.

- The goods are then officially cleared for sale or consumption.

RESTRICTED PRODUCE

The Department of Agriculture has the ability to restrict or limit the amount or total importation of specific goods that are entering the Turks and Caicos. If certain goods are imported, specific import conditions must be met prior to arriving to the Turks and Caicos. Below is a list of items that are restricted or have to go through even further regulations to be able to be imported into the Turks and Caicos:

- Mangoes (i.e., from fruit-fly free areas or hot water treated)

- Passion Fruit (i.e., pulp only)

- Fresh guavas

- Fresh cherries

- Specific breeds of dogs, birds, & fishes

- Meat products from countries with notifiable animal diseases.

- Plants from areas where specific plant diseases or pests are present.

IMPORT BREACHES

If it is found that a person/company has tried to operate or import goods that fall under the Department of Agriculture’s purview illegally without the proper permits or requisites, import breaches can be placed on the imported good or produce. In the case of an import breach, the following can take place:

- Fines for illegally attempting to/importing products

- Refusal of entry at the port

- Re- export (pets)

- Confiscation for destruction

For more information concerning the importation of agricultural goods, you may e-mail the Department of Agriculture via agriculture@gov.tc or call them on +1(649)338-5269 (Providenciales) or on +1(649)338-3882 (Grand Turk).

Step 4: Review Restrictions/Prohibitions/Sanctions

The Department of Customs has the right to prohibit and restrict the importation of various goods into the Turks and Caicos. These restrictions not only apply based on the class of the imported good but can vary in addition to restricting trade from various countries of origin. To find a list of the possible categories of goods that may be restricted, prohibited or a list of sanctioned nations, please visit the Customs Department website using the following hyperlink - https://customs.gov.tc/pgs?pg=clearanceprocedures or contact the Customs Department directly for the exhaustive list.

Step 5: Check if you Qualify for Exemptions/Concessions

There are concessions or exemptions that are provided to specific classes or categories of individuals within the Turks and Caicos. These concessions or exemptions are granted in certain cases pursuant to Section 70 and 71 of the Customs Ordinance. To find a list of the possible categories of goods that may qualify for import exemptions, please visit the Customs Department website using the following hyperlink - https://customs.gov.tc/pgs?pg=exemptions or contact the Customs Department directly for the exhaustive list.

Step 6: Review the Applicable Customs Tariff

The classification of goods is done using the Harmonized Commodity Description and Coding System (HS System). This is an internationally standardized system used by the World Customs Organization to classify traded products. Tariffs are taxes/duty applied to goods listed in the HS System. These can vary depending on the commodity. The Customs Department has a Tariff Finder where individuals can search a product by its classification/name and find out what is the tariff duty rate for each item. The Tariff Finder can be accessed using the following hyperlink - https://customs.gov.tc/trf. To find an estimate of how many duties/fees would have to be paid, there is a free Duty Calculator, which can be accessed using the following hyperlink - https://customs.gov.tc/cltr.

Step 7: Find out about Customs Declarations and Payment Options

All Customs Declarations are currently submitted online. At this point in time, the Customs Department does not charge for the issuing of permits to traders. Traders can collect relevant permits either in person or through various online methods. While the issuing of permits does not have a fee attached currently, in order to clear imported goods and products, payments from the trader must be paid to the Customs Departments. These are the current available methods that a trader can use to pay their fees:

Cash, Debit/Credit Card & Cheque (via the TCIG Treasury Department)

Debit/Credit Card (via the Customs Department)

Online Payments treasuryreceipts@gov.tc