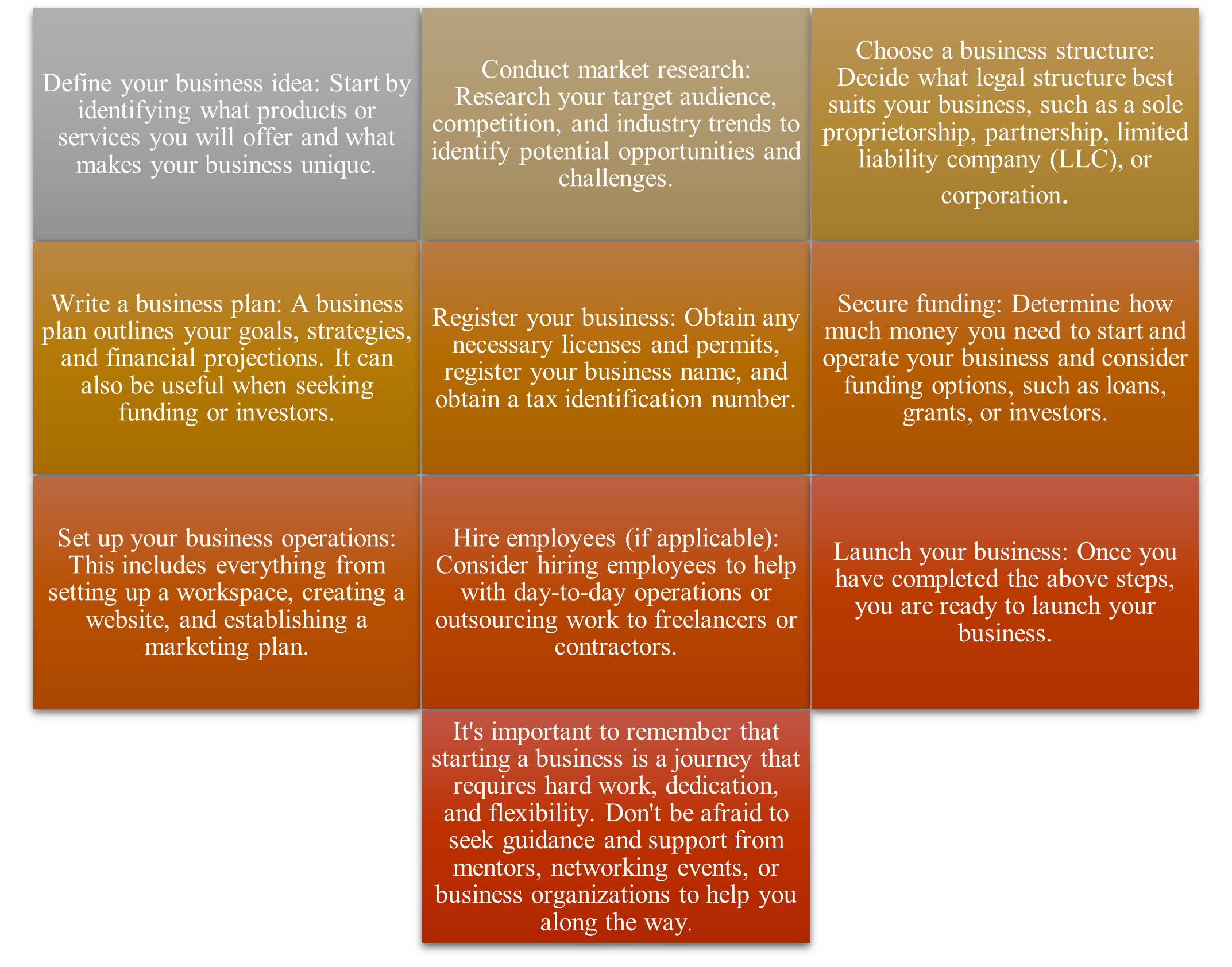

Key Steps to Consider when Starting a Business

Starting a business can be fulfilling, but it requires hard work and dedication. A clear business idea, a solid plan and market research can help you stay on track. The benefits of owning a business include independence, higher earnings, personal growth, and community impact. It is crucial to consider legal and financial aspects such as obtaining permits and licenses and registering the business.

Here are some key steps you should consider when starting a business:

Business Licensing

Are you considering launching a business venture? Have you secured all the necessary legal paperwork to get started? The following guide offers valuable insights on how to obtain the required business license before you can begin trading.

| Business Structure | Documents Required |

| Sole Trader |

|

| Corporation |

|

| Partnership |

|

Kindly note that if the business activity of interest is a “Reserved” category (shown as “R” on the Business License Fee Schedule located at the following hyperlink https://busreg.gov.tc/busreg/PDF/Fee%20Schedule6%20120315.pdf), the Belonger applicant MUST maintain controlling interest in the business (51% or more ownership).

All activities that are “Restricted” (shown as “X” on the Business License fee schedule located at the following hyperlink - https://busreg.gov.tc/busreg/PDF/Fee Schedule6 120315.pdf) are approved by the Ministry of Finance. Visit https://www.gov.tc/revenue/ to view the Business License Fee Schedule.

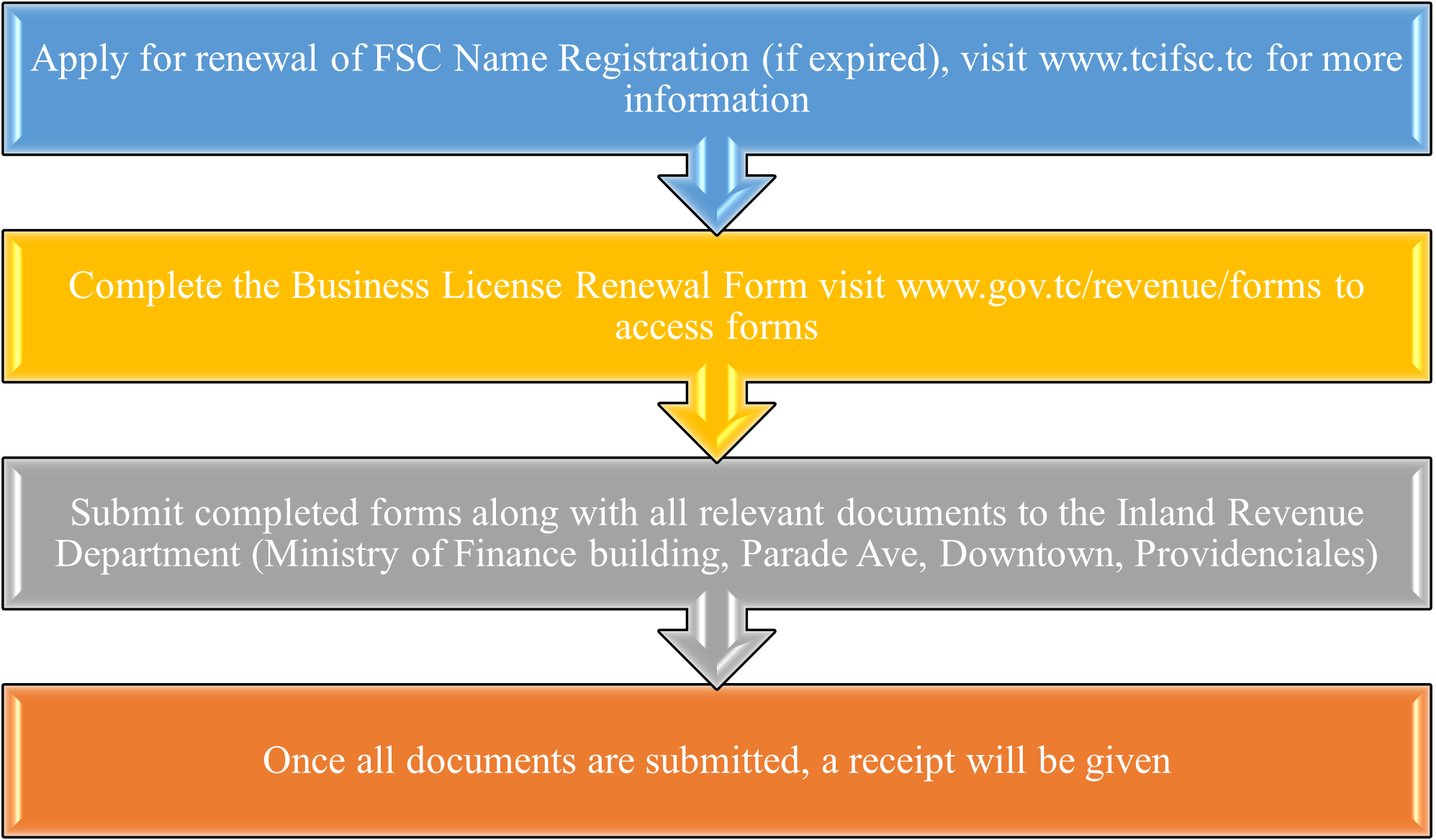

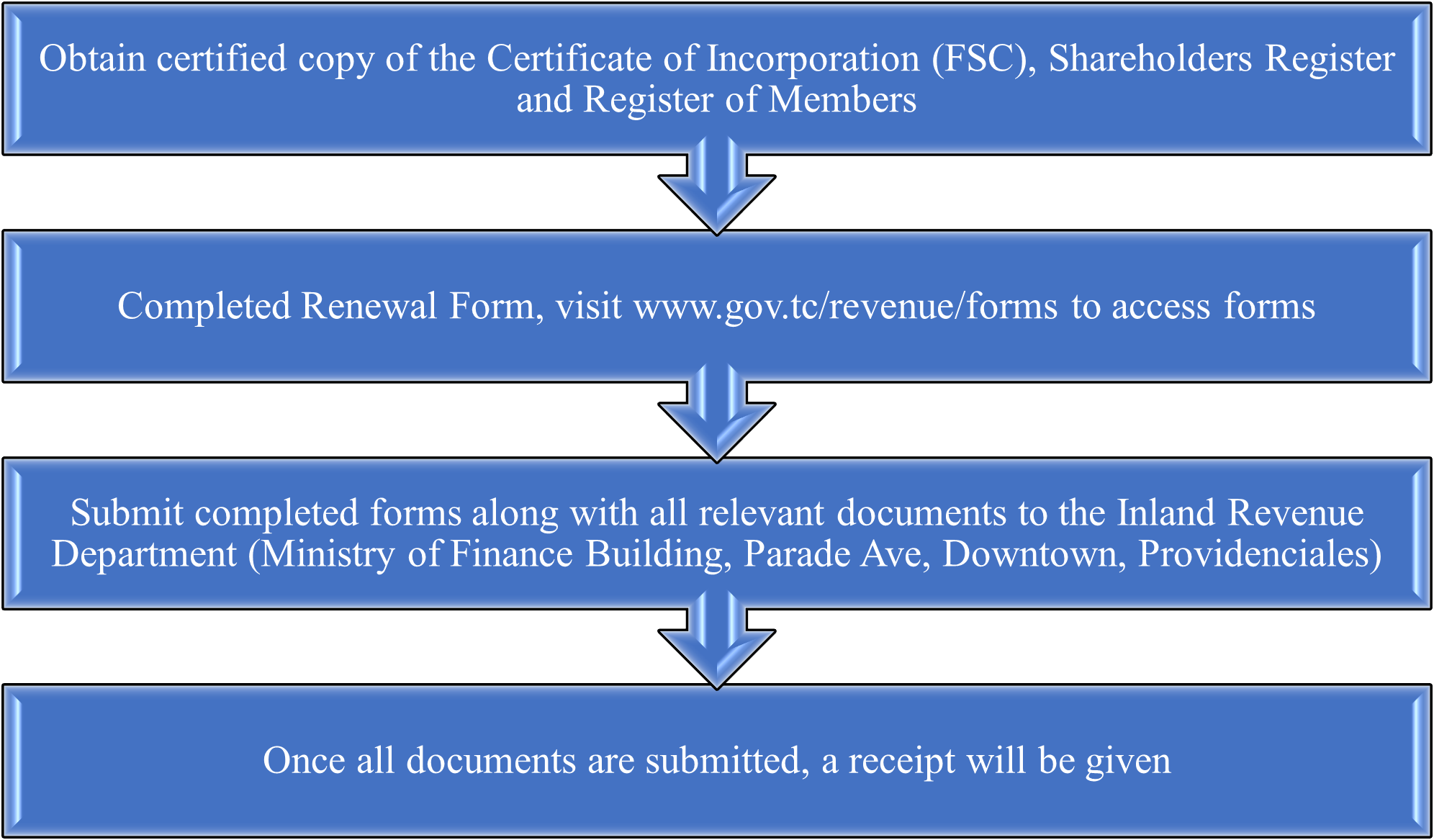

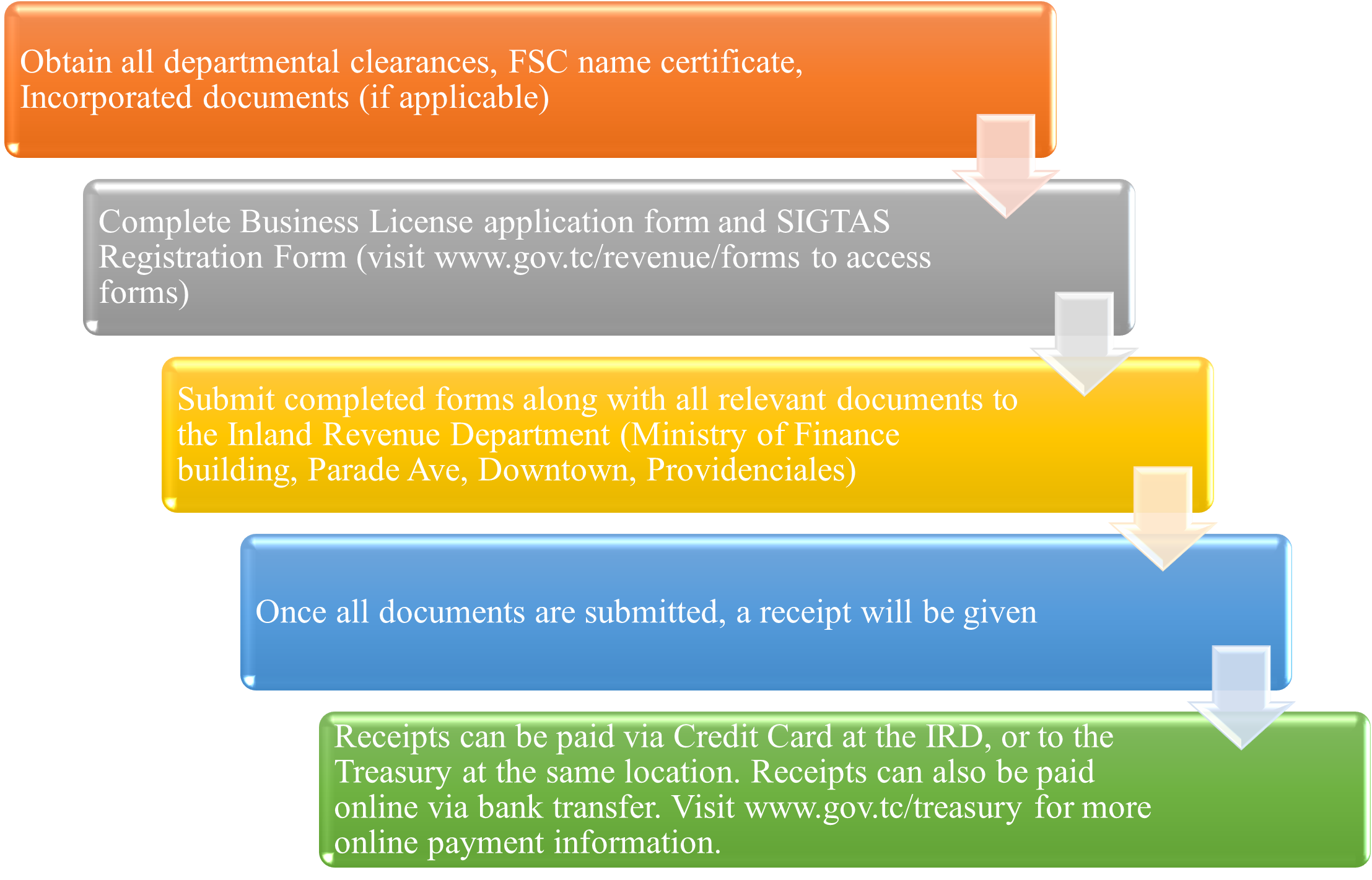

If applying in person, follow these steps:

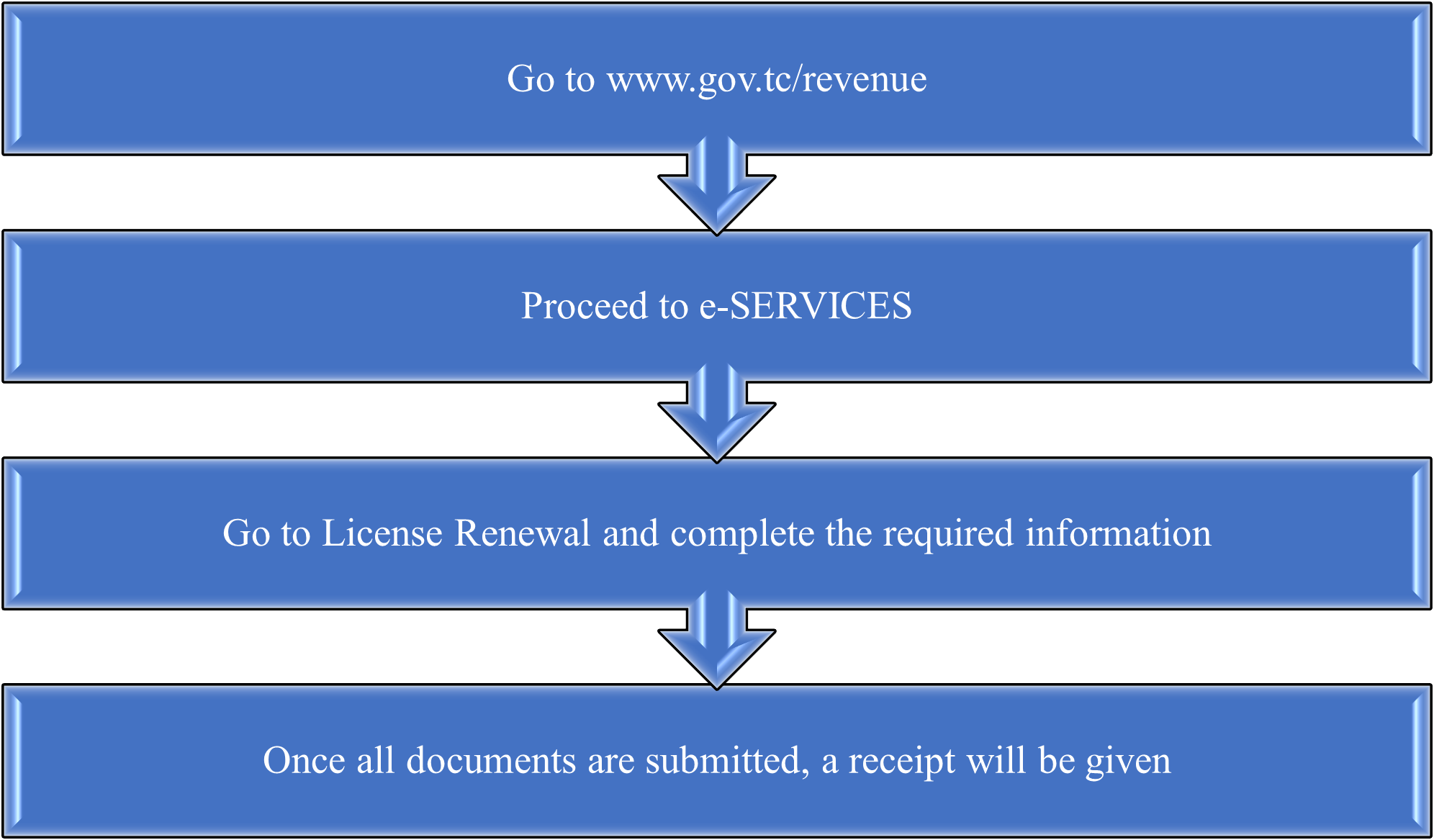

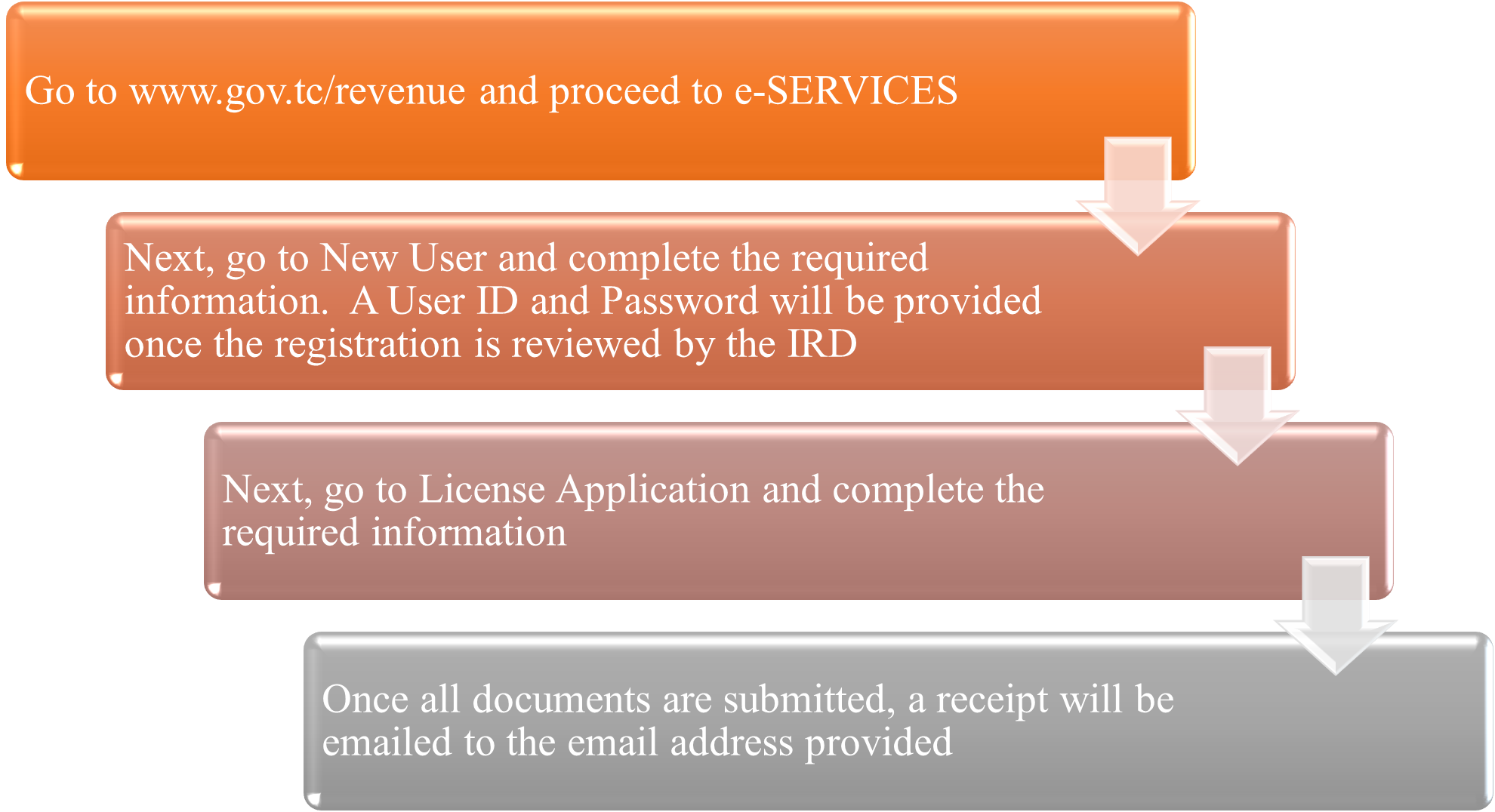

To submit a business license application online via the E-Services portal, follow these steps:

Payments

Receipts can be paid via Credit Card at the Inland Revenue Department (IRD), or to the Treasury at the same location. Receipts can also be paid online via bank transfer. Visit www.gov.tc/treasury for more online payment information.

Important Information

- For more information regarding Business License fees, contact the IRD on +1 (649) 338-5234 or email tcirevenuedepartment@gov.tc.

- Applications can take up to two weeks to be approved and certificate/s printed.

- Business Licenses can be collected from the Inland Revenue Department. A copy of a government-issued ID is needed for collection.

Kindly note that the original license should be properly displayed at the business location. Licenses are valid for one year, starting March, with a grace period of one month. Penalties for non-renewal usually commence in May